ESG Disclosures

ESG – Environmental, Social & Governance

ESG – Environmental, Social & Governance

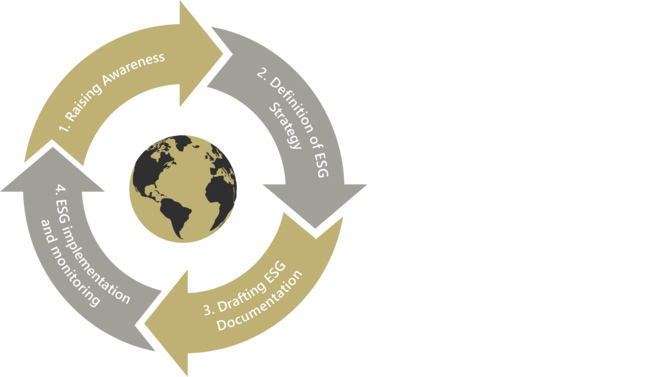

Capital Bay Group SA ("Capital Bay Group") has implemented an ESG process to facilitate the integration of an effective ESG strategy into its business and operational activities (which also includes Capital Bay Fund Management Sàrl "CBFM").

We have a dedicated ESG task force that implements the following principles to address environmental, social and governance issues related to our business activities:

Taking into consideration the devastating effects of climate change has led us to include the assessment and monitoring of our exposures to the following set of sustainability risks as part of our regular risk management process:

These risks have been integrated in our governance framework and our remuneration policy has been updated to consider the abovementioned sustainability risks and their impact on the investment decision-taking processes.

They have further been made a foundational steppingstone of our Investment process, which is described in the Portfolio Management Policy.

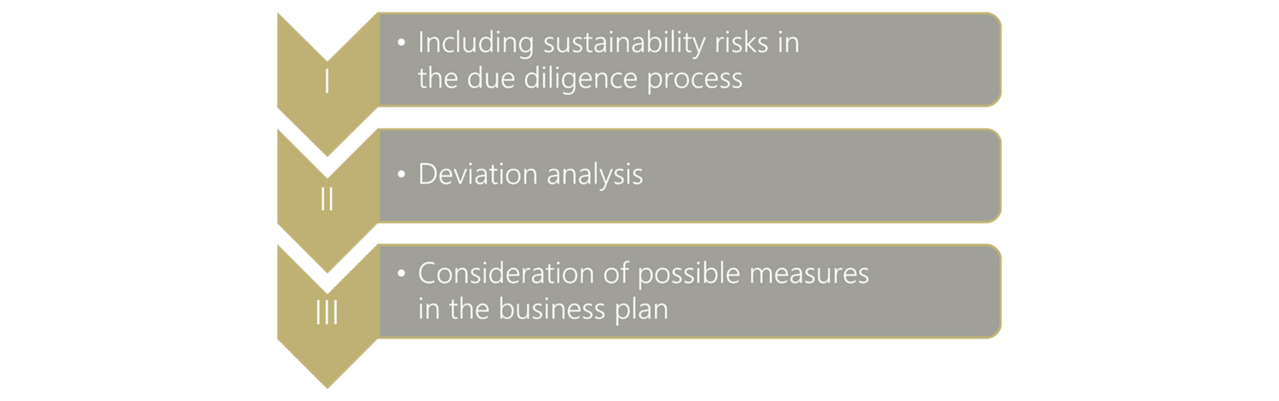

Moreover, their assessment has been made part of the Due Diligence process within the internal Portfolio Management Procedure for new acquisitions.

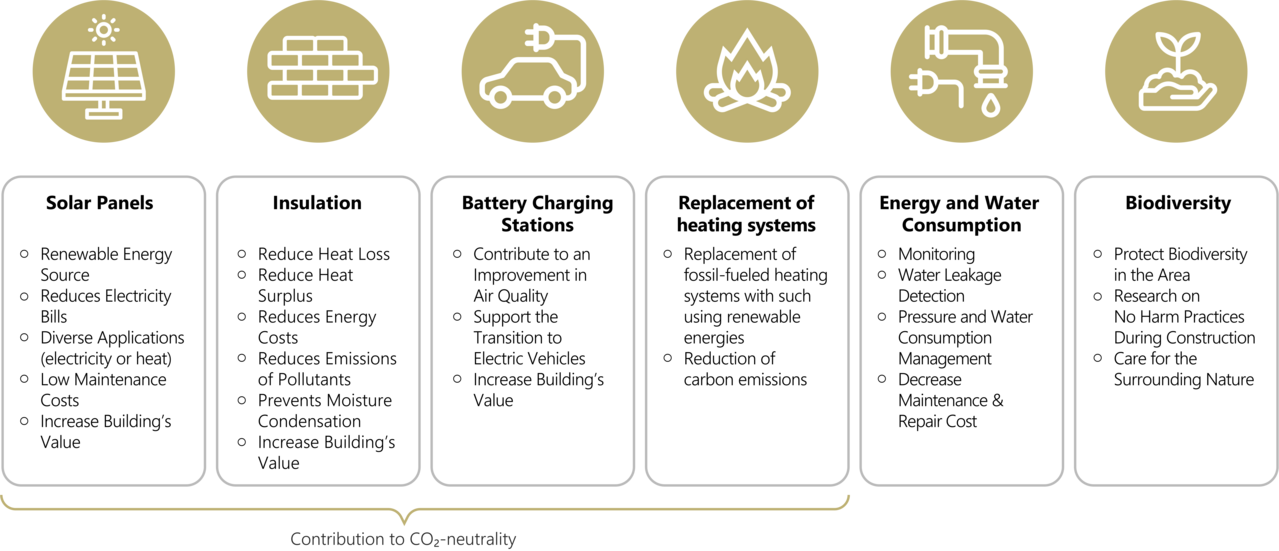

Capital Bay Group manages primarily Real Estate Funds. The principle adverse impacts of real estate assets are:

Our ESG policy sets out a framework for a set of rules, whose purpose it is to guide the Company’s staff on how to be more responsible towards environmental, social and governance concerns in their daily work in order to promote sustainability, fight against climate change and reduce any risks that may arise.

Capital Bay Group is accountable for its impact on the environment, the relationship with its community and the way of governance. Environmental, social and governance principles are embedded across our operations and help ensure the sustainability of our business well into the future. Capital Bay Group firmly believes that adhering to ESG principles is key to creating long-term value.

While the CBFM generally considers certain sustainability risks in its Fund investment activity, it does currently not evaluate the principal adverse impacts of investment decisions made on a uniform set of sustainability factors in the meaning of article 2(24) of SFDR with respect to all compartments of the Funds under management by the CBFM given the overall difficulties in collecting the necessary information for this purpose and the resources required to put in place the adequate processes. We are aiming to collect the relevant data for the managed assets as foreseen in Annex 1 of the SFDR Level II Regulation.

To address these impacts, we are planning to implement the following action points:

As stewards of the environment, we inform and educate our counterparties how they can reduce resource usage and improve environmental quality. We encourage our funds and investors to be greener and choose a more sustainable approach towards their operations.

We monitor our funds and actively engage with them to improve sustainability performance and corporate behaviour. We may also engage with counterparties where our ESG-integrated research process has highlighted that there are material financial risks arising from sustainability issues or based on the Company’s strategic priorities (e.g. clean energy and sustainable real estate). Similar initiatives will be implemented in the future for the Company to meet its sustainability goals.

We spread awareness to our fund initiators, promoters, and investors to be more involved in greener investment decisions and comply with an ESG framework such as the UN Principles for Responsible Investment. In respect of real estate investments, we encourage our fund stakeholders to apply for a voluntary green certification, such as Energy Star, LEED, NGBS, DGNB, BREEAM, HQE, CASBEE, GRESB, Greenmark and other platforms.

The United Nations Global Compact is a non-binding United Nations pact to encourage businesses worldwide to adopt sustainable and socially responsible policies, and to report on their implementation. It is a principle-based framework for businesses, stating ten principles in the areas of human rights, labour, the environment, and anti-corruption. Member companies are expected to engage in specific business practices that benefit the people and the planet while pursuing profitability with integrity. The 10 principles for businesses, as stated on the UN Global Compact’s website, are the following:

Principle 1: Support and respect the protection of internationally proclaimed human rights.

Principle 2: Ensure that business practices are not complicit in human rights abuses.

Principle 3: Uphold the freedom of association and the effective recognition of the right to collective bargaining.

Principle 4: Eliminate all forms of forced and compulsory labour.

Principle 5: Abolish child labour.

Principle 6: Eliminate discrimination in employment and occupation.

Principle 7: Adopt a precautionary approach to environmental challenges.

Principle 8: Conduct environmentally responsible activities.

Principle 9: Encourage the development and diffusion of environmentally friendly technologies.

Principle 10: Fight corruption in all its forms including extortion and bribery.

Companies that join the compact should integrate these principles into their corporate strategies, culture, and day-to-day operations. Companies are also expected to advocate the principles publicly and communicate with stakeholders on progress toward meeting the principles.

See also: https://www.unglobalcompact.org/what-is-gc/mission/principles