Fund Management

As an AIFM fully regulated in Luxembourg, we are experts in

both national and international fund management.

As an AIFM fully regulated in Luxembourg, we are experts in

both national and international fund management.

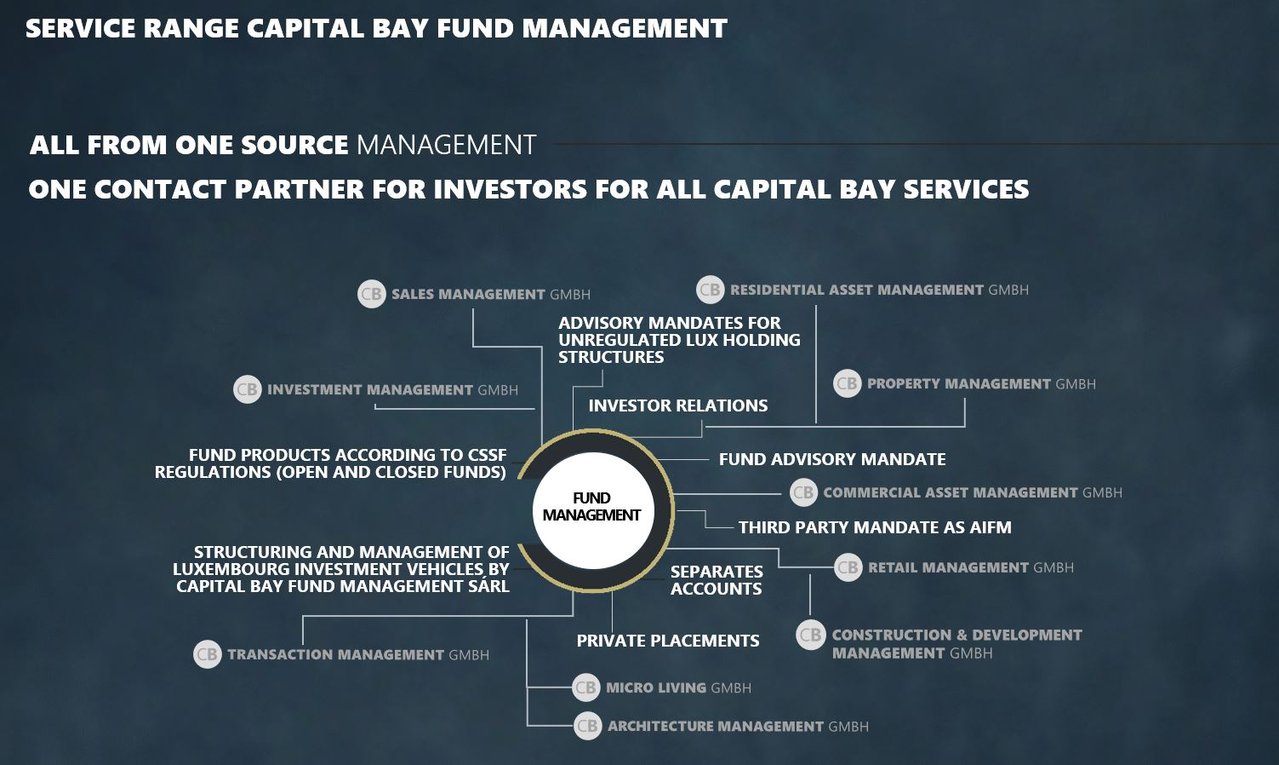

We issue investment funds with a range of investment strategies in various asset classes and handle the entire spectrum of services, from project development to existing properties. We develop customised solutions for institutional investors, family offices and investment companies in Germany, Europe and around the world. Capital Bay Fund Management Sárl is the specialist for international institutional investors for all kinds of fund structuring solutions around the globe. At the forefront of this stand security and stability, the result of transparent and reasoned investment strategies as well as substantial experience working with institutional investors.

With our wide and varied expertise in international fund management and our full license under Luxembourg law for real estate and private equity, we’re able to develop tailor-made solutions for international institutional investors. Our top priorities here are each client’s specific requirements, performance and service quality particularly in investor reporting, as well as strict adherence to regulatory requirements: CLIENTS FIRST!

Our organisational structure offers investors an interdisciplinary collaboration between all service companies and guarantees a holistic approach to client support. Our investor-specific and high quality services allow us to implement investments that are highly bespoke.

Our investment philosophy is defined by entrepreneurial thought and action. Many years’ experience designing, establishing and managing all significant investment vehicles gives our key managers a keen awareness and deep understanding of the needs of managers and investors. Customised solutions are designed and implemented using each company’s specific strategy as a starting point and taking into account all client-specific and regulatory requirements.

As an investment manager, we attach great importance to ensuring that all investment products and strategies comply with the standards of the ESG guidelines. Environmentally sustainable as well as politically and ethically correct operations are the cornerstones of responsible corporate governance for Capital Bay.